How to Register and Trade Crypto at BTSE

How to Register at BTSE

How to Register a BTSE account【PC】

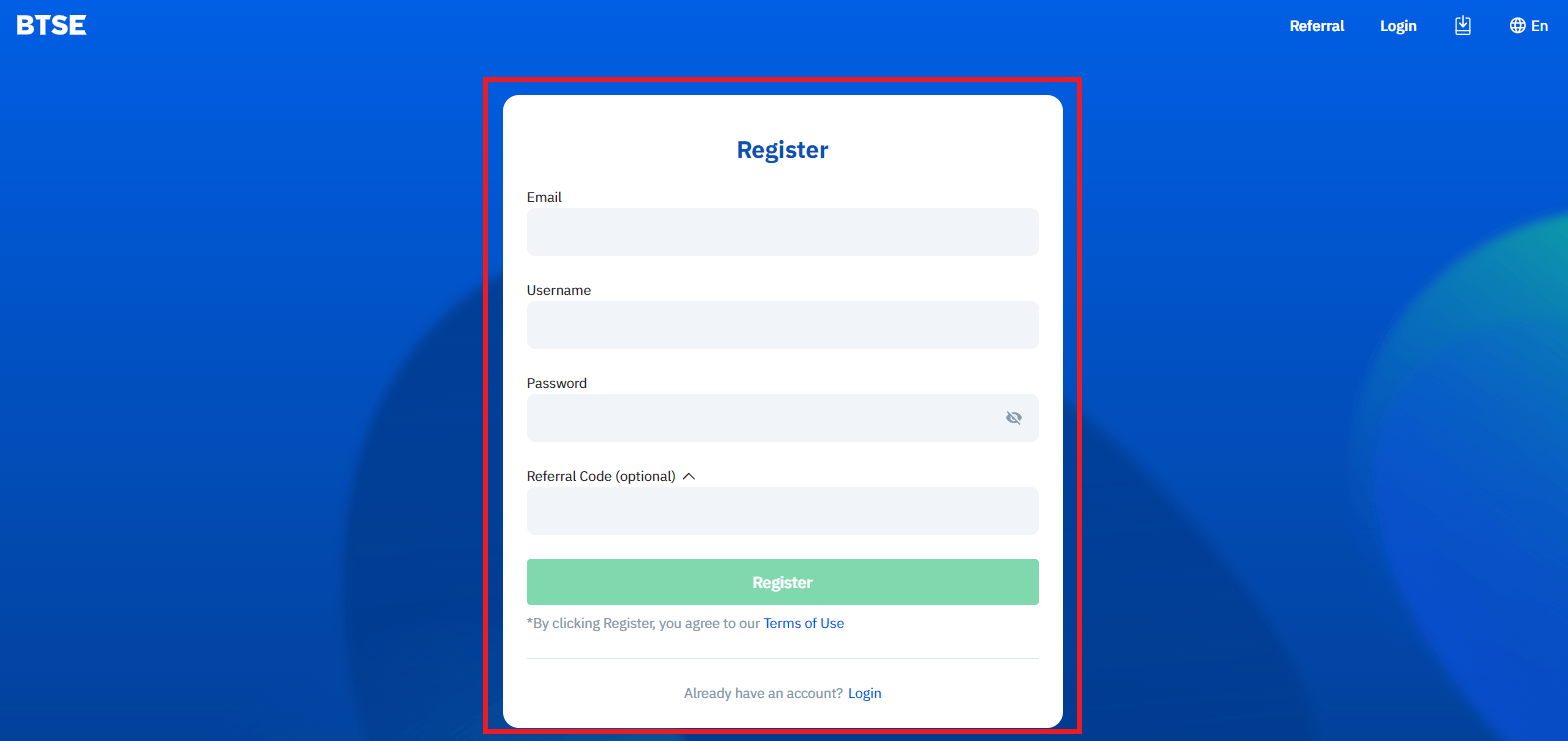

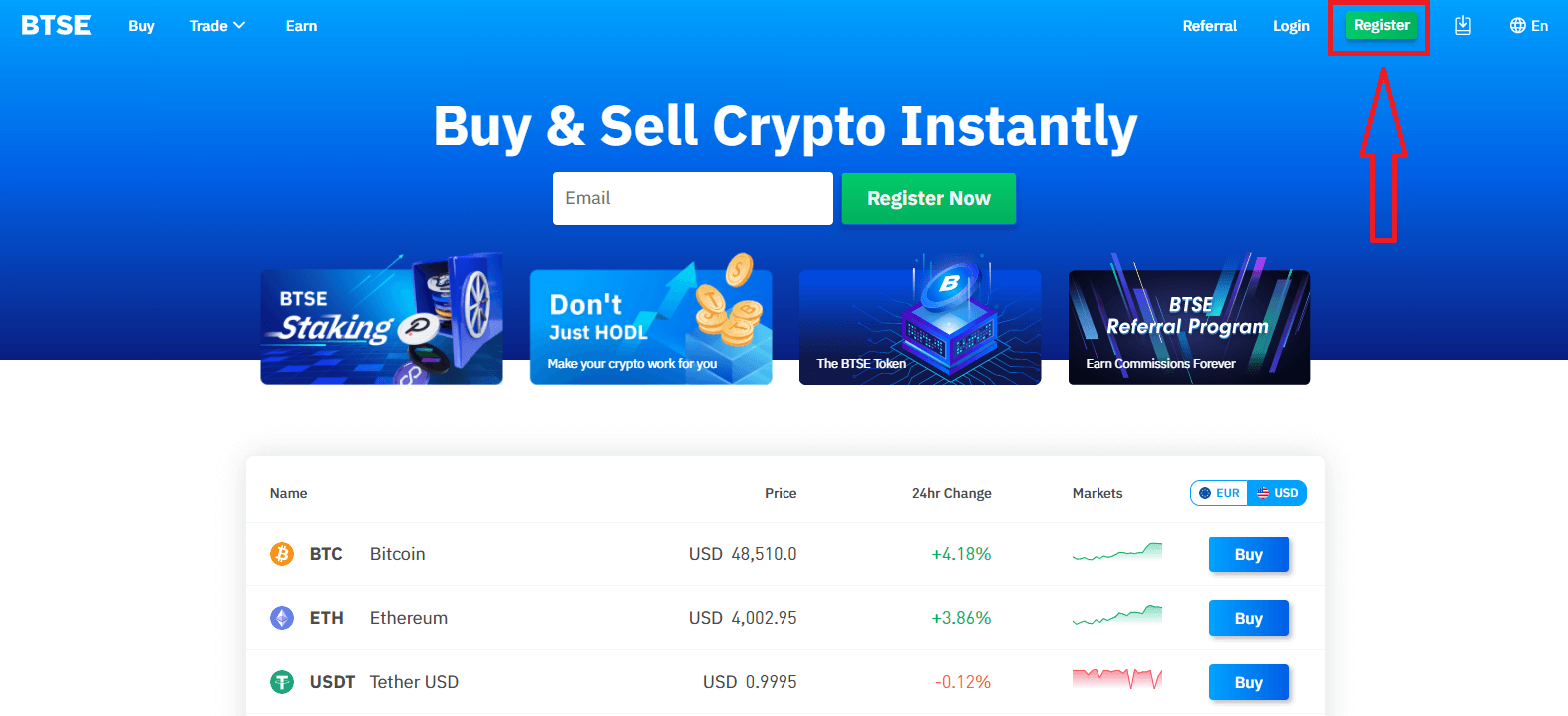

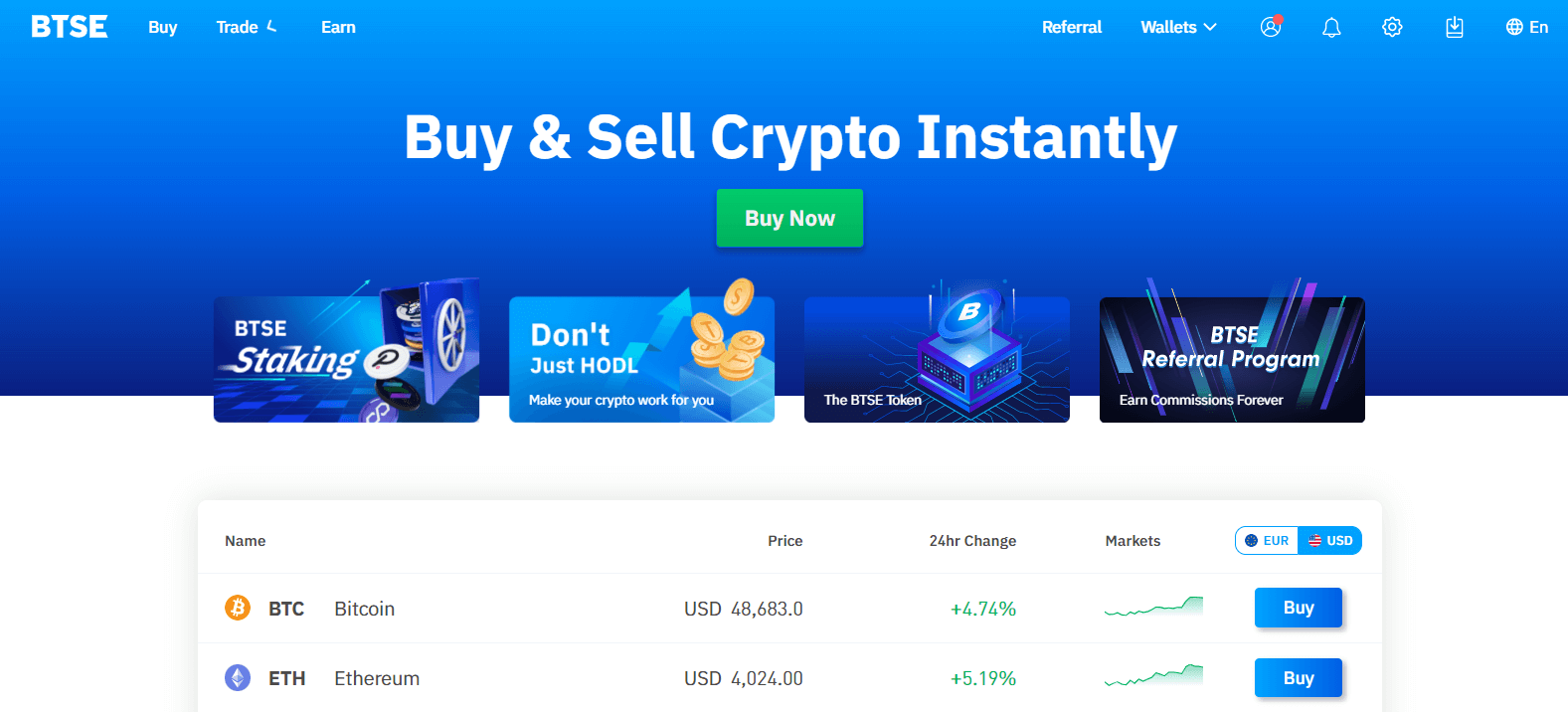

For traders on the web, please head over to the BTSE. You can see the registration box on the center of the page.

If you are on another page, such as the Home page, you can click “Register” in the upper right corner to enter the registration page.

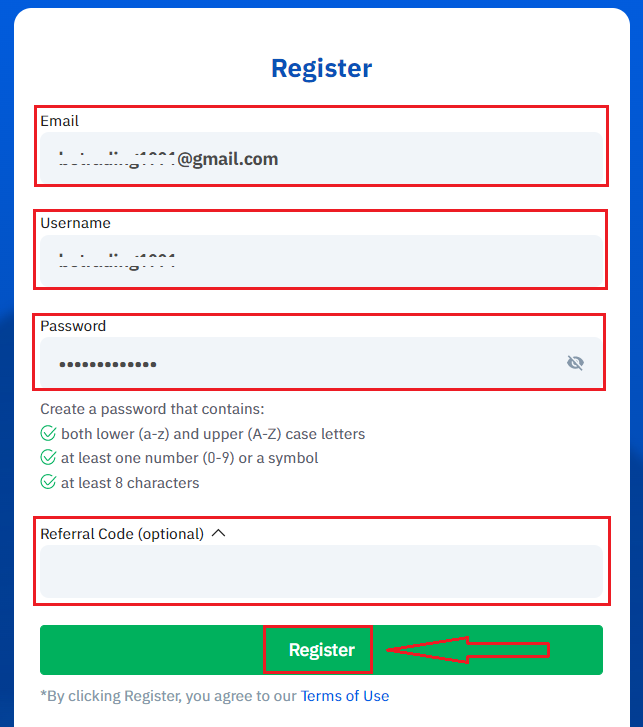

Please enter the following information:

- Email address

- Username

- Your password must contain at least 8 characters.

- If you have a referrer, please click "Referral Code (optional)" and fill it.

Make sure you have understood and agree to the Terms of Use, and after checking that the information entered is correct, click “Register”.

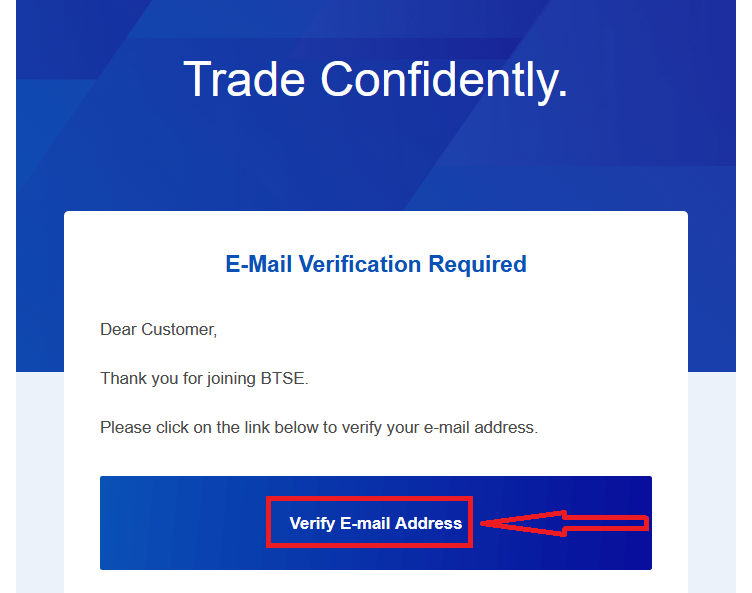

After submitting the form, check your email inbox for the registration confirmation. If you have not received the verification email, kindly check your email’s spam folder.

Click the confirmation link to complete the registration and start using cryptocurrency trading (Crypto to crypto. For example, use USDT to buy BTC).

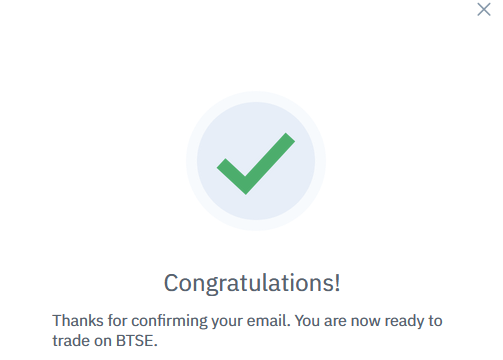

Congratulations! You have successfully registered an account on BTSE.

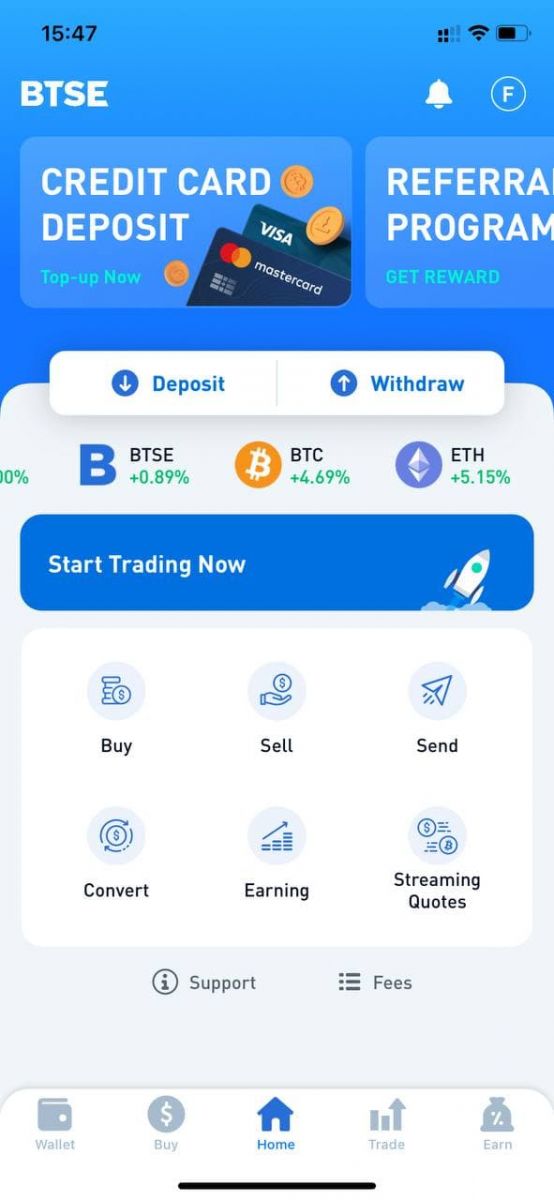

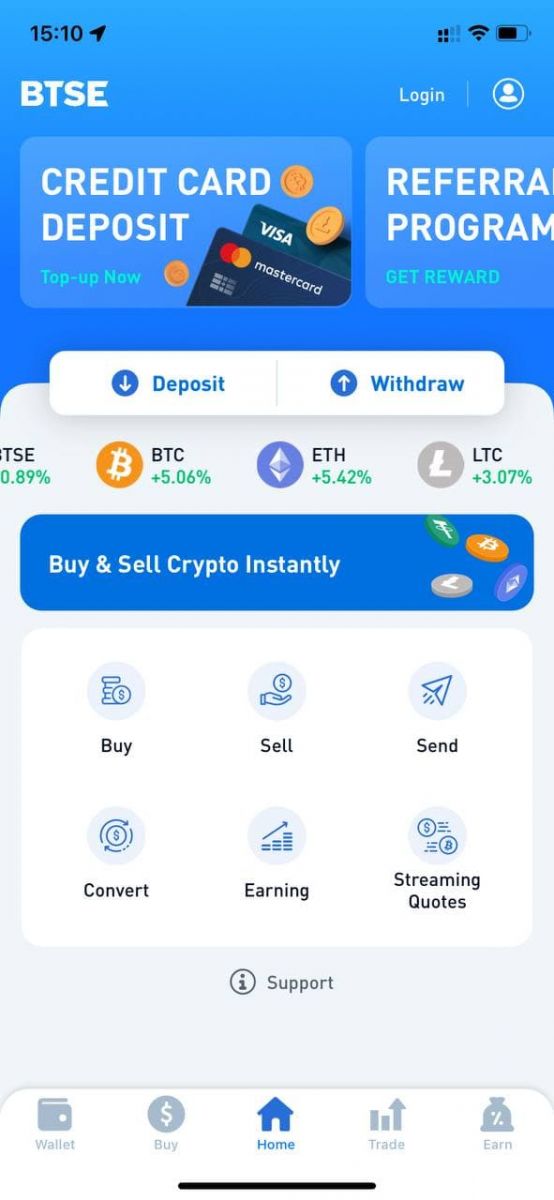

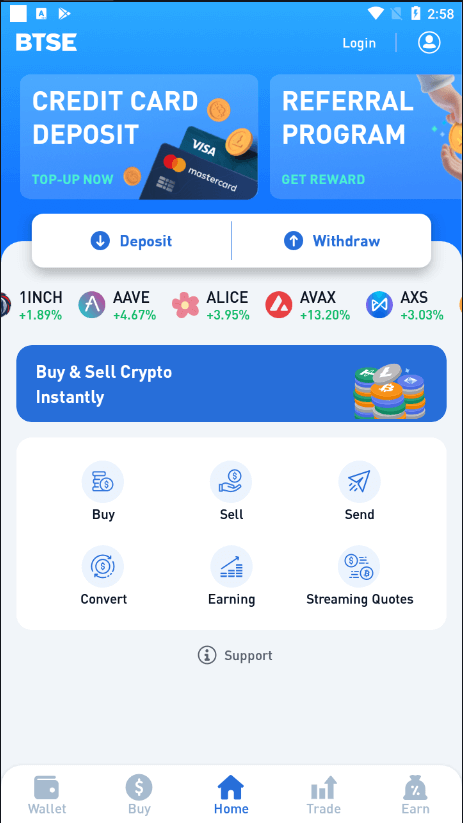

How to Register a BTSE account【APP】

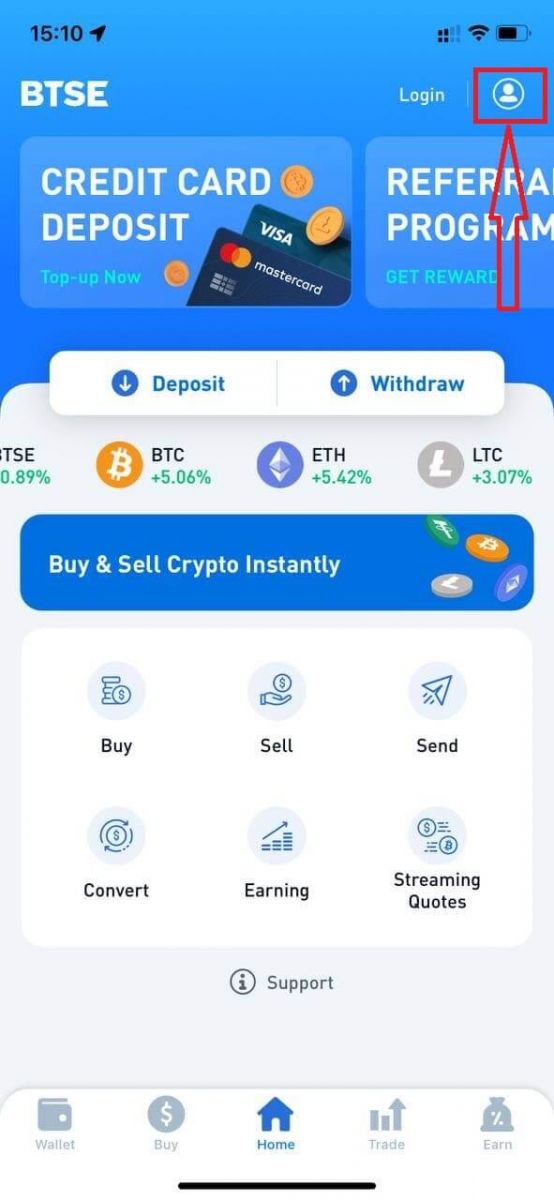

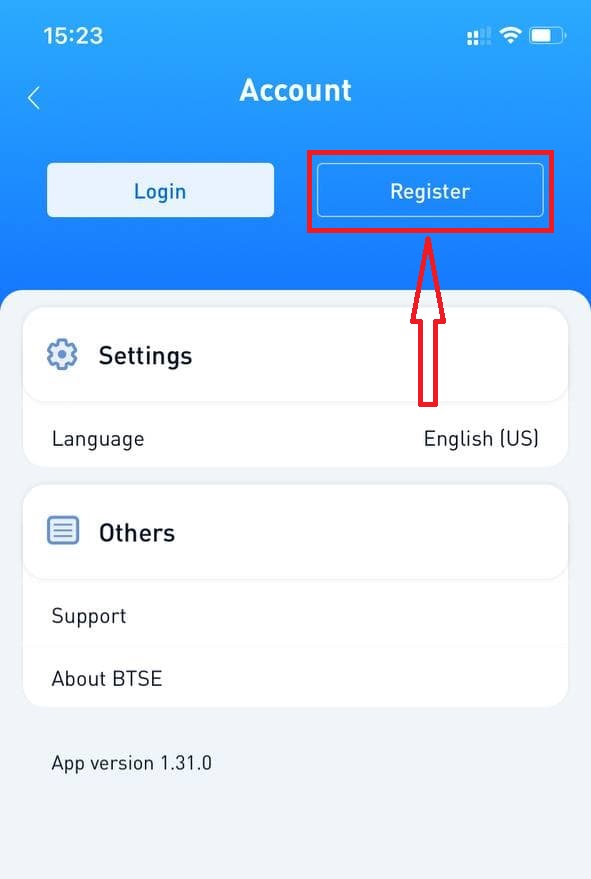

For traders using BTSE’s app, you can enter the registration page by clicking a person icon at the upper right corner.

Click "Register".

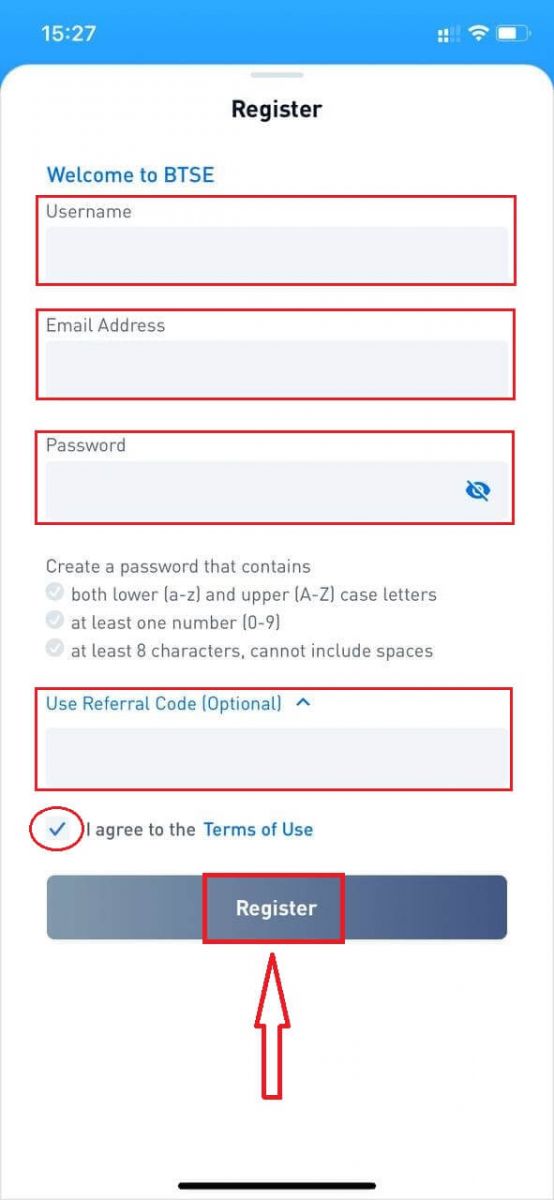

Next, Please enter the following information:

- Username.

- Email address.

- Your password must contain at least 8 characters.

- If you have a referrer, please click "Referral Code (optional)" and fill It.

Make sure you have understood and agree to the Terms of Use, and after checking that the information entered is correct, click “Register”.

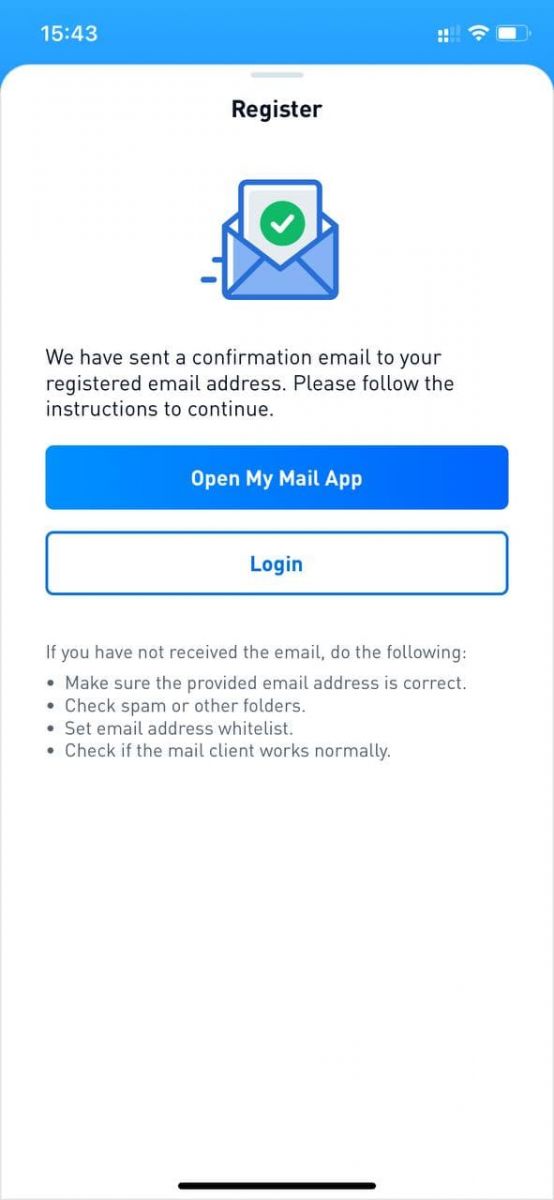

After submitting the form, check your email inbox for the registration confirmation. If you have not received the verification email, kindly check your email’s spam folder.

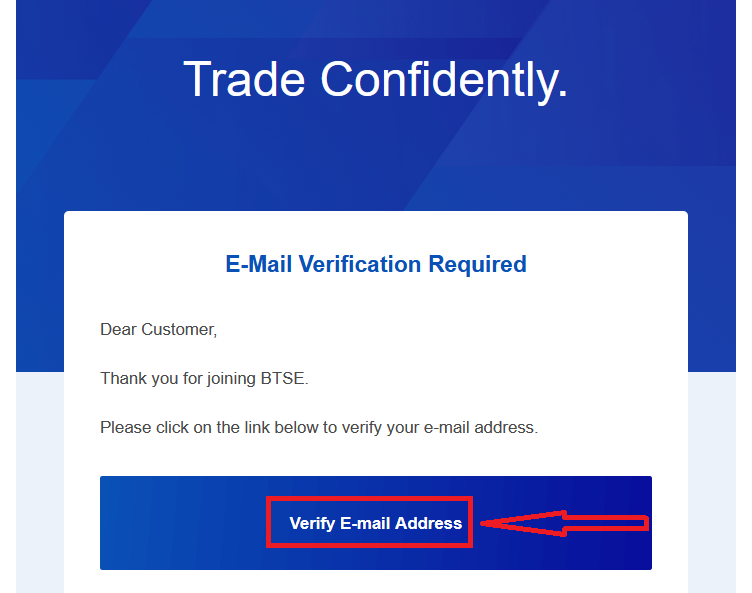

Click the confirmation link to complete the registration and start using cryptocurrency trading (Crypto to crypto. For example, use USDT to buy BTC).

Congratulations! You have successfully registered an account on BTSE.

How to Install BTSE APP on Mobile Devices (iOS/Android)

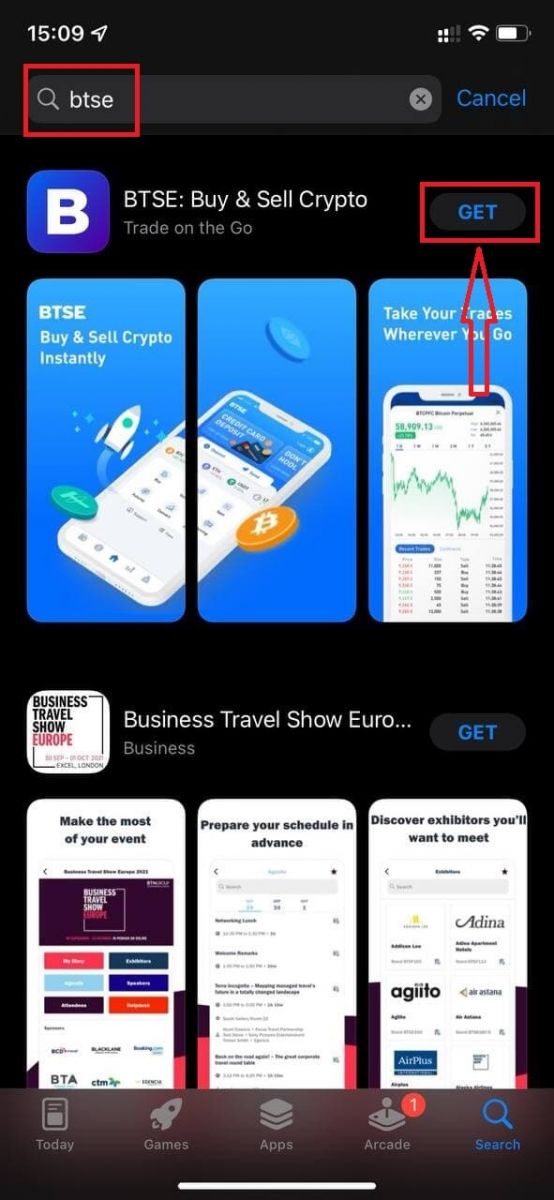

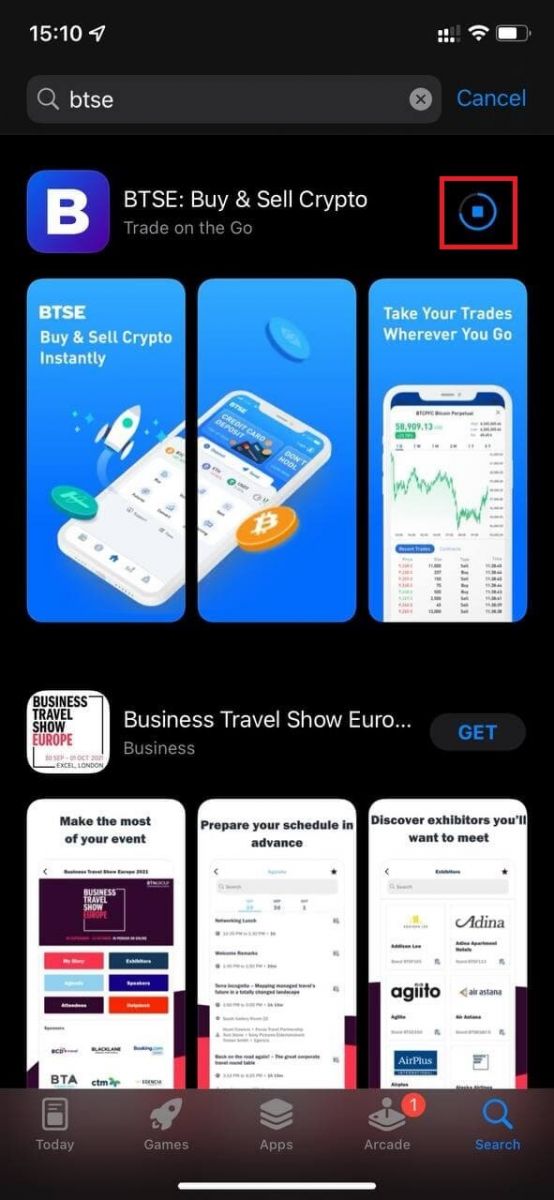

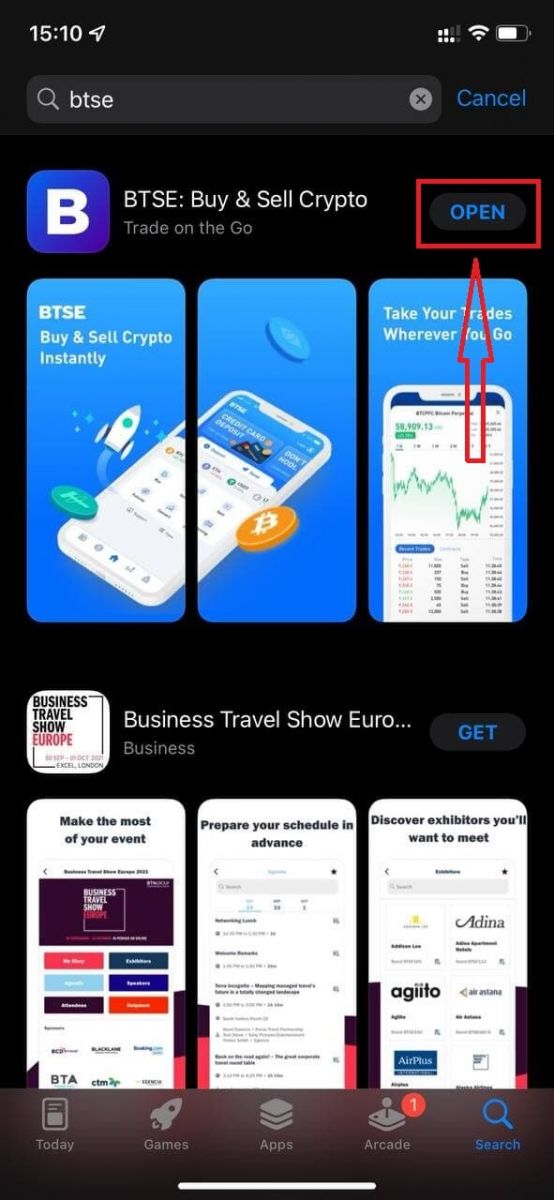

For iOS devices

Step 1: Open "App Store".Step 2: Input "BTSE" in the search box and search.

Step 3: Click on the "Get" button of the official BTSE app.

Step 4: Wait patiently for the downloading to complete.

You can click "Open" or find the BTSE app on the home screen as soon as the installation is completed to start your journey to cryptocurrency!

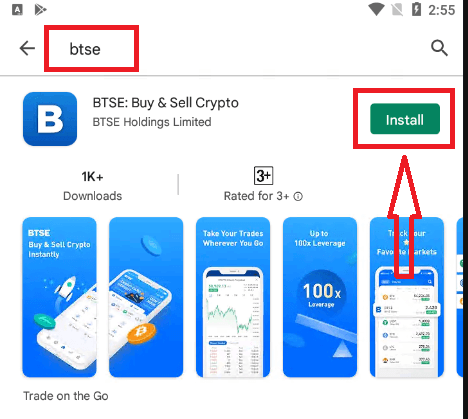

For Android devices

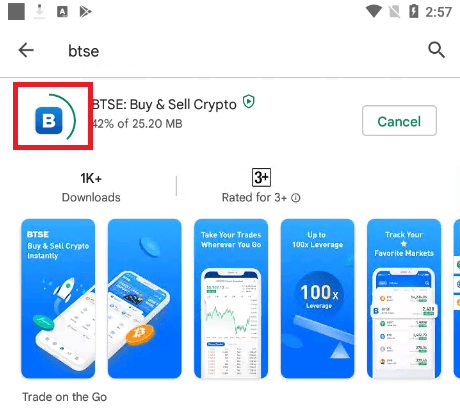

Step 1: Open "Play Store".Step 2: Input "BTSE" in the search box and search.

Step 3: Click on the "Install" button of the official BTSE app.

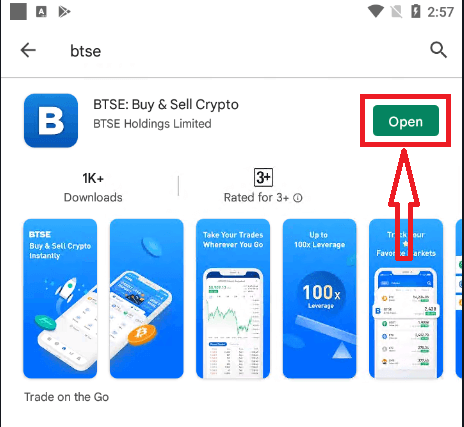

Step 4: Wait patiently for the downloading to complete.

You can click "Open" or find the BTSE app on the home screen as soon as the installation is completed to start your journey to cryptocurrency!

How to Trade Crypto at BTSE

Spot trading

How to Conduct Spot Trading

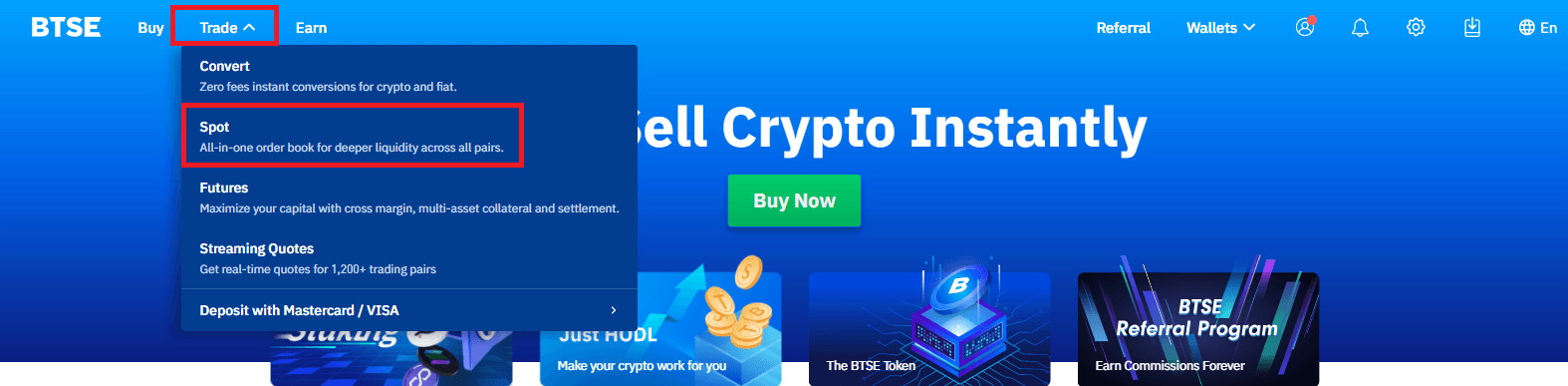

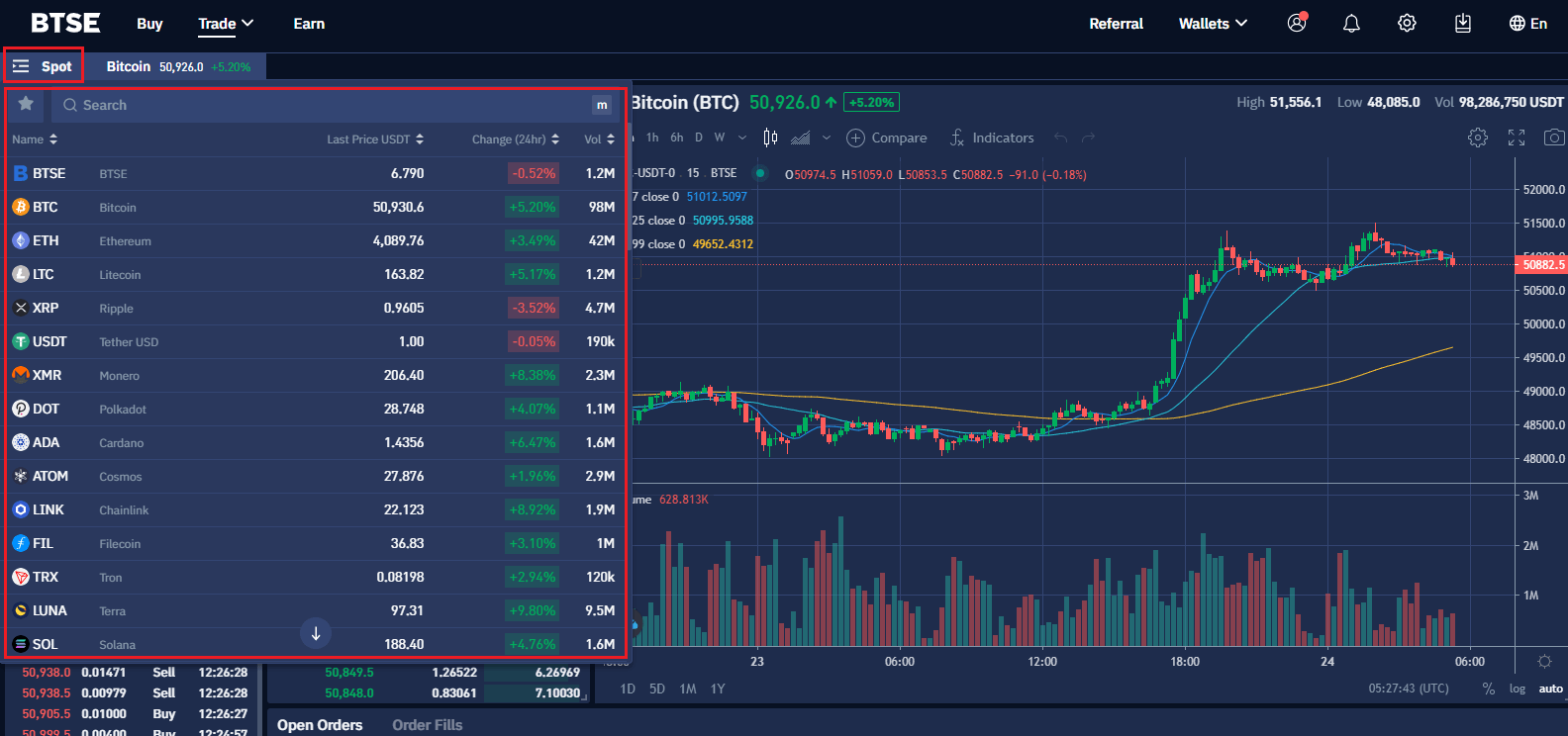

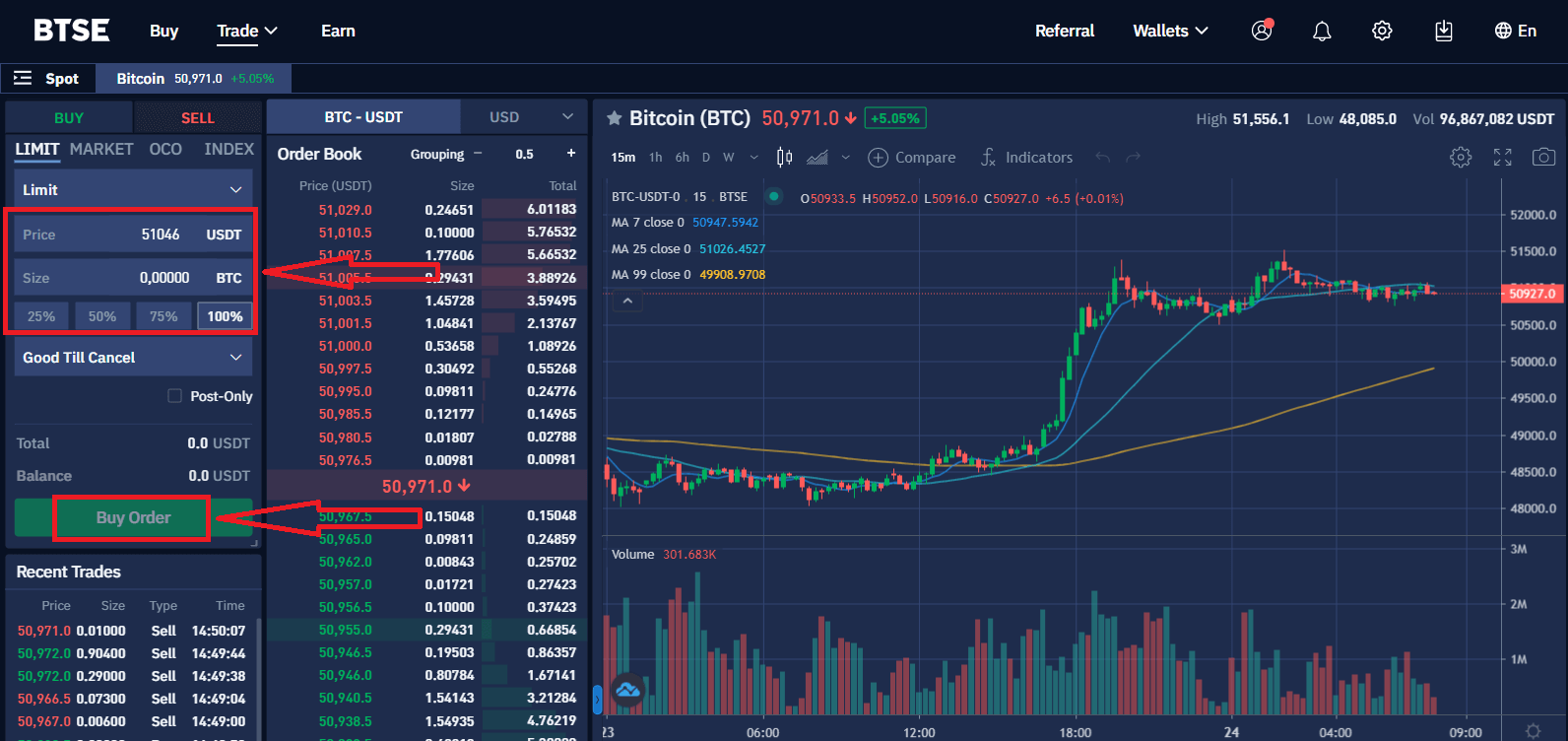

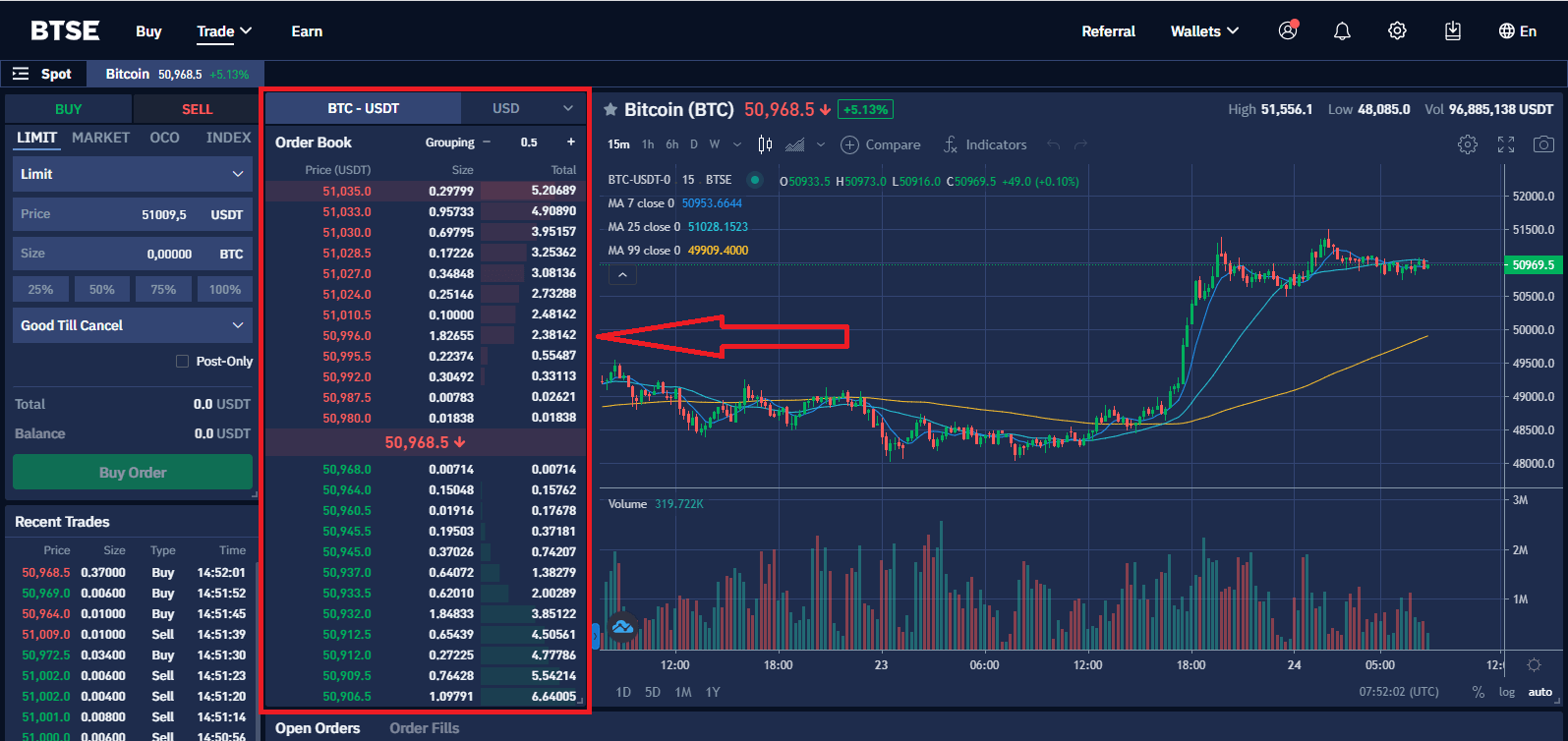

Step 1: Log in to your account. Click on "Spot" under "Trade" on the top navigation bar.

Step 2: Search and enter the pair you want to trade.

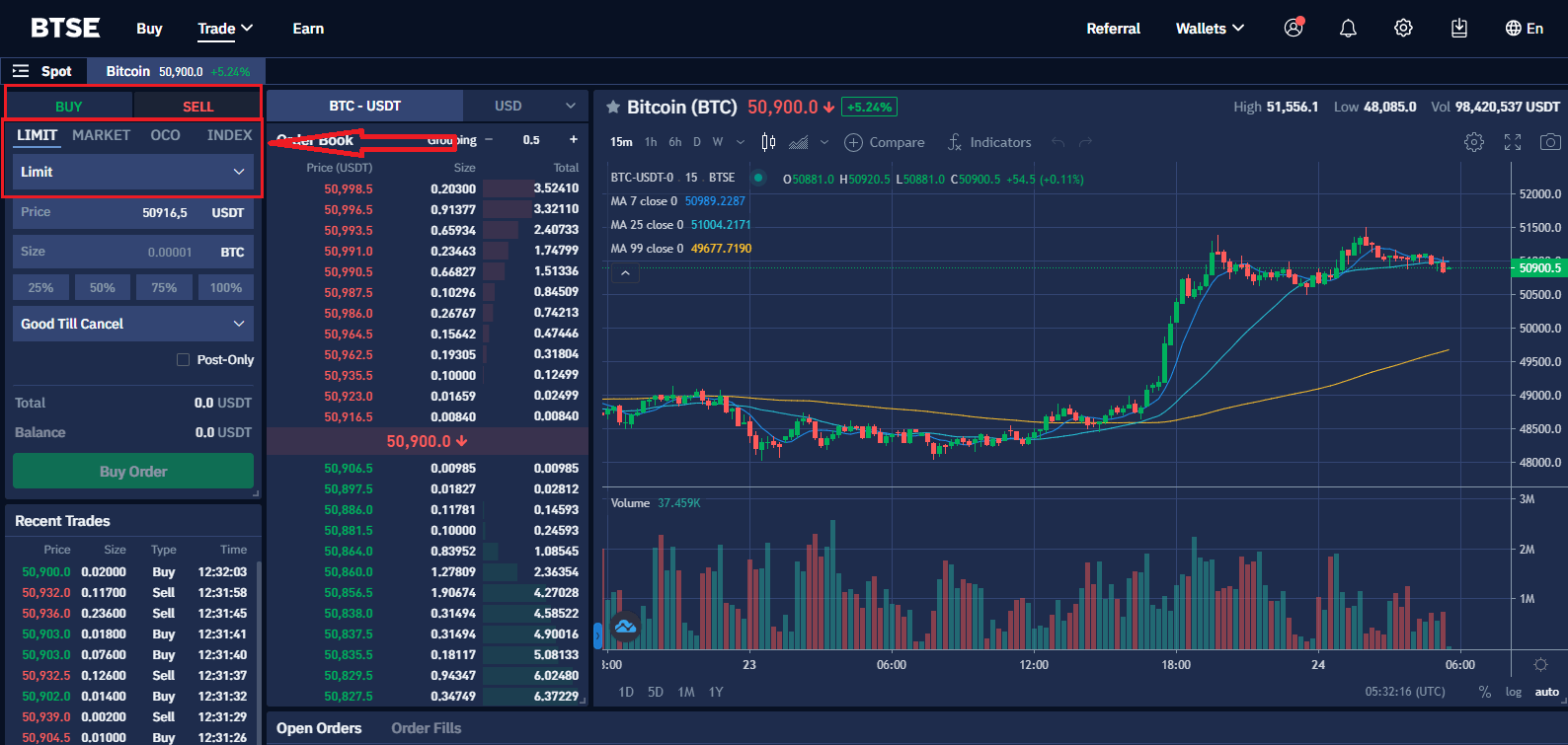

Step 3: Select Buy or Sell and Order type

Step 4: Set buying/selling prices and buying/selling amount (or exchange total). Then click on "Buy Ỏrder"/"Sell Order" to submit your order.

(Note: The percentages under the "Size" box refer to certain percentages of the account balance.)

Or click on the last prices on the order book to set the buying/selling price conveniently.

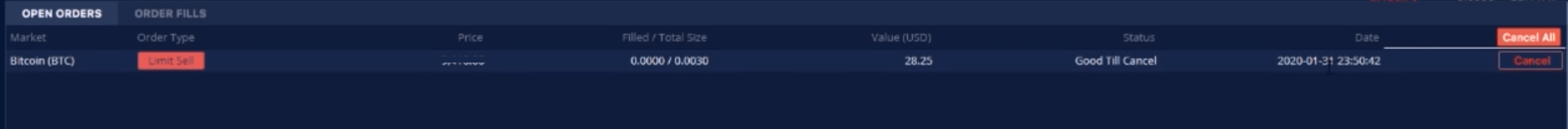

Step 5: After successfully placing an order, you will be able to view it in "Open Orders" at the bottom of the page. You can also cancel the order here by clicking on "Cancel".

Spot Trading Fees

- Trading fees are deducted from the currency you receive.

- The account fee level is determined based on a 30-day rolling window of trading volume, and will be recalculated daily at 00:00 (UTC).

- Trading volume is calculated in BTC. Non-BTC trading volume is converted into BTC equivalent volume at the spot exchange rate.

- BTSE does not allow users to self-refer through multiple accounts.

| 30-Day Vol. (in USD) |

/or | BTSE Token Holding |

Maker | Taker | Maker | Taker |

| Or | 0.10% | 0.12% | 0.080% | 0.096% | ||

| ≥ 500K | And | ≥ 300 | 0.09% | 0.10% | 0.072% | 0.080% |

| ≥ 1M | And | ≥ 600 | 0.08% | 0.10% | 0.064% | 0.080% |

| ≥ 5M | And | ≥ 3K | 0.07% | 0.10% | 0.056% | 0.080% |

| ≥ 10M | And | ≥ 6K | 0.07% | 0.09% | 0.056% | 0.072% |

| ≥ 50M | And | ≥ 10K | 0.07% | 0.08% | 0.056% | 0.064% |

| ≥ 100M | And | ≥ 20K | 0.06% | 0.08% | 0.048% | 0.064% |

| ≥ 500M | And | ≥ 30K | 0.05% | 0.07% | 0.040% | 0.056% |

| ≥ 1B | And | ≥ 35K | 0.04% | 0.06% | 0.032% | 0.048% |

| ≥ 1.5B | And | ≥ 40K | 0.03% | 0.05% | 0.024% | 0.040% |

| ≥ 2.5B | And | ≥ 50K | 0.02% | 0.04% | 0.016% | 0.032% |

Order Types in Spot Trading

Limit Orders

Limit Orders are used to manually specify the price a trader is willing to buy or sell at. Traders use limit order to minimize their trading cost.

Market Orders

Market Orders are orders that are executed immediately at the current market price. Traders use this order type when they have an urgent execution.

* Market Price is the last settlement price on BTSE.

Index Orders

Index orders are used for traders who would like to place an order in which the price tracks a certain percentage above/below the BTSE BTC index price.

The fields are detailed as follows:

Maximum/Minimum Price:

- Buy Order: if maximum price is $4,000 and BTC index is $3,900, then the users order will be $3,900

- Minimum price would be the opposite of maximum price and applies to a Sell order

Contract:

- The number of contracts the user would like to purchase

Percentage:

- If a positive value is entered, the effective price would be a percentage above the BTC index price

- If a negative value is entered, the effective price would be a percentage below the BTC index price

- The maximum percentage value allowed is +/- 10%

Stealth Mode:

- This function will help you buy/sell a pointed percentage of your digital currencies once at a time

Stop Orders

Stop orders are orders that do not enter the order book until the market price reaches the trigger price.

The purpose of this order is:

- A risk-management tool to limit losses on existing positions

- An automatic tool to enter the market at a desired entry point without manually waiting for the market to place the order

Stop orders can be selected under the place Order Tab. There are three status that are shown during the execution of a stop order:

- OPEN - The requirements for your order have yet been met

- TRIGGERED - Your order has been placed

- FILLED - Your order has been completed

Take Profit Orders

Traders use this by specifying Market Order or Limit Order instructions to be executed once the market price reaches the predefined triggered price.

- Take profit orders are used for setting the estimated price that you believe your contracts will reach

- Stop orders are used for decreasing the risk of being liquidated if your current contracts move in the wrong direction

There are two types of Take Profit Orders:

- Take Profit Limit Order - You set the predefined Trigger Price and Order Price. When the market price reaches your trigger price, your order will be placed on the order book

- Take Profit Market Order- You set the predefined Trigger Price. When the current market price reaches your trigger price, a Market Order will be placed on the order book

Take Profit Orders can be selected under the place order tab, it will show you the triggering price and take profit price. The status of stop orders can be found on the Active Orders tab. There are three Status that are shown during the execution of a Take Profit Order:

- OPEN - The requirements for your order have yet been met.

- TRIGGERED - Your order has been placed.

- FILLED - Your order has been completed.

Active Orders and Stops Tab

Active Orders Tab: This tab will show any active orders that have not yet been completed.

Stop Tab: take profit orders and stop orders will be listed under this tab until the orders are triggered and completed.

Futures Trading

How to Deposit into Your Futures Wallet

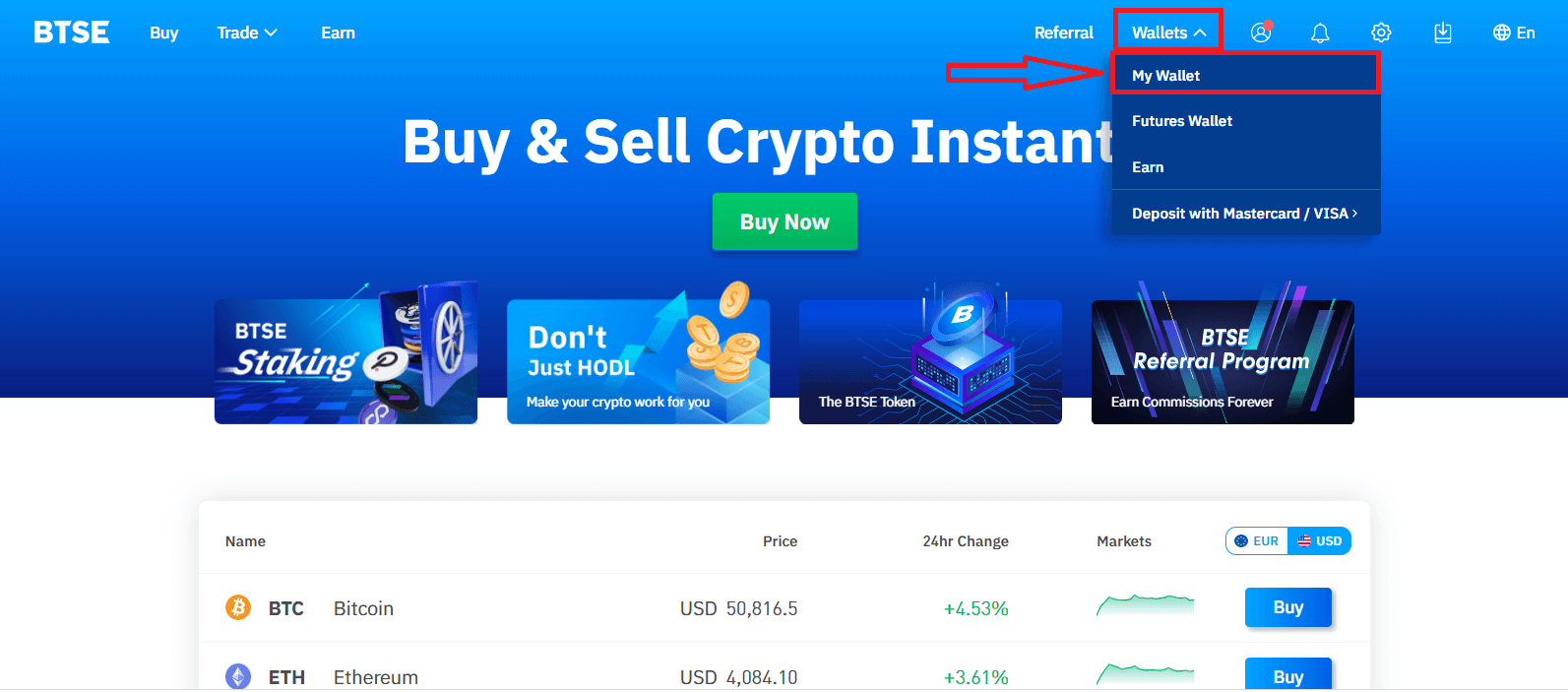

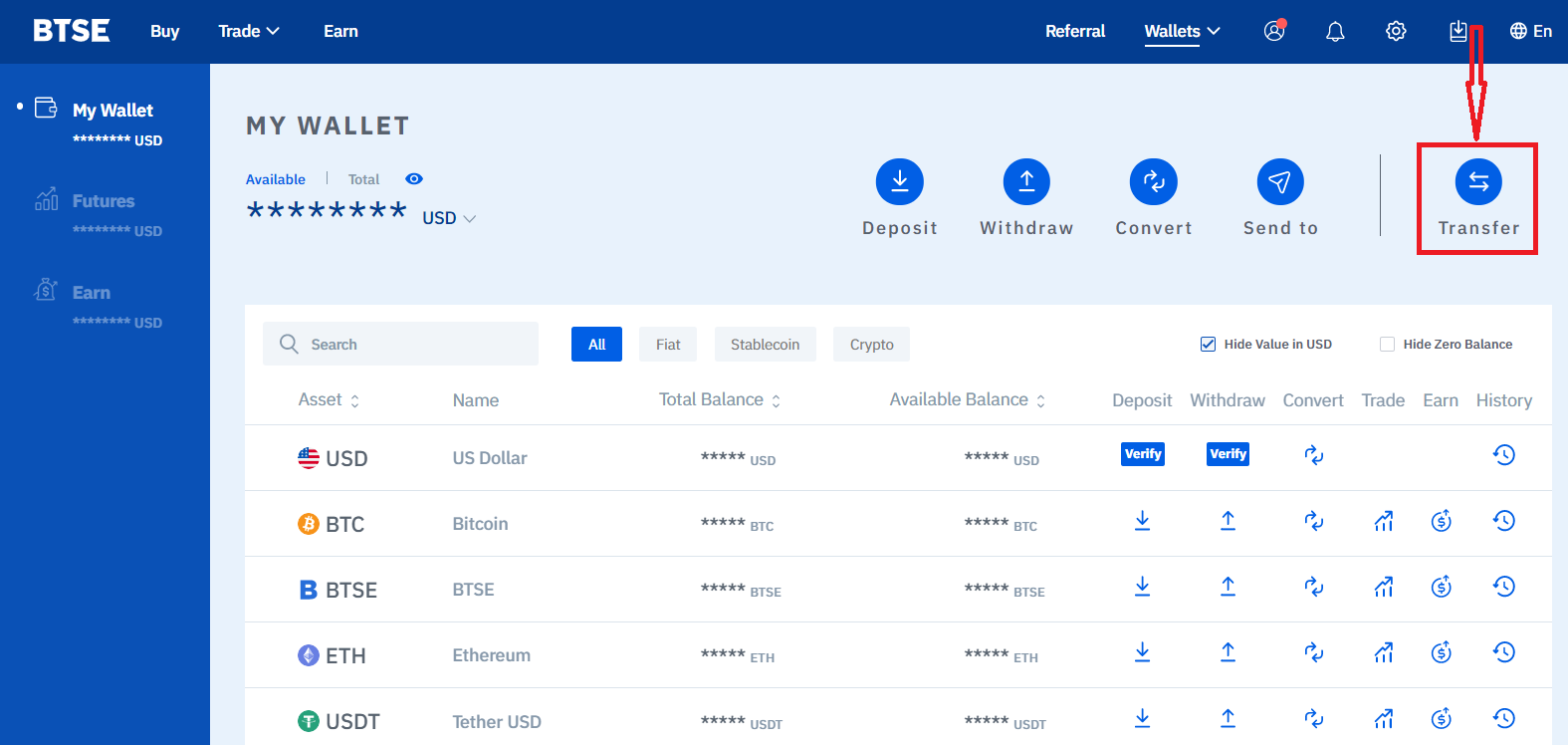

Step 1. Click Wallets

Step 2. Click Transfer

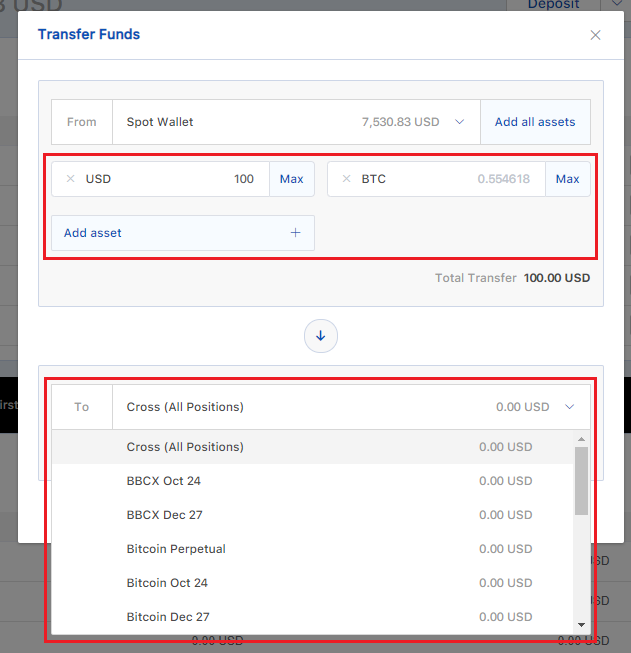

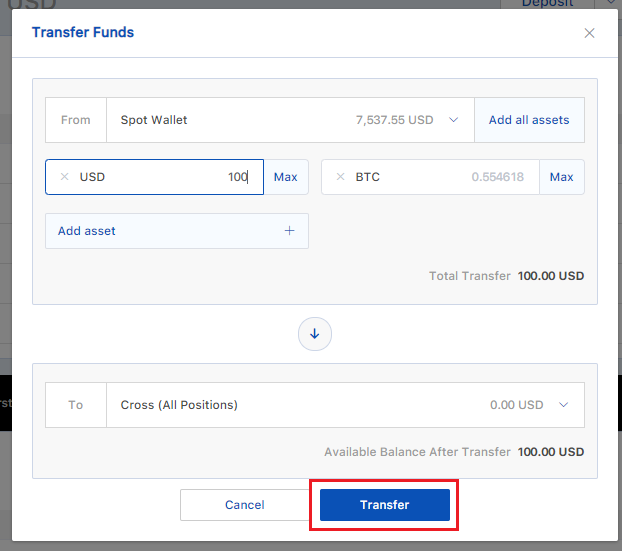

Step 3. Enter the Transfer Amount and select a Cross / Isolated Wallet

Step 4. Click Transfer to complete the deposit process

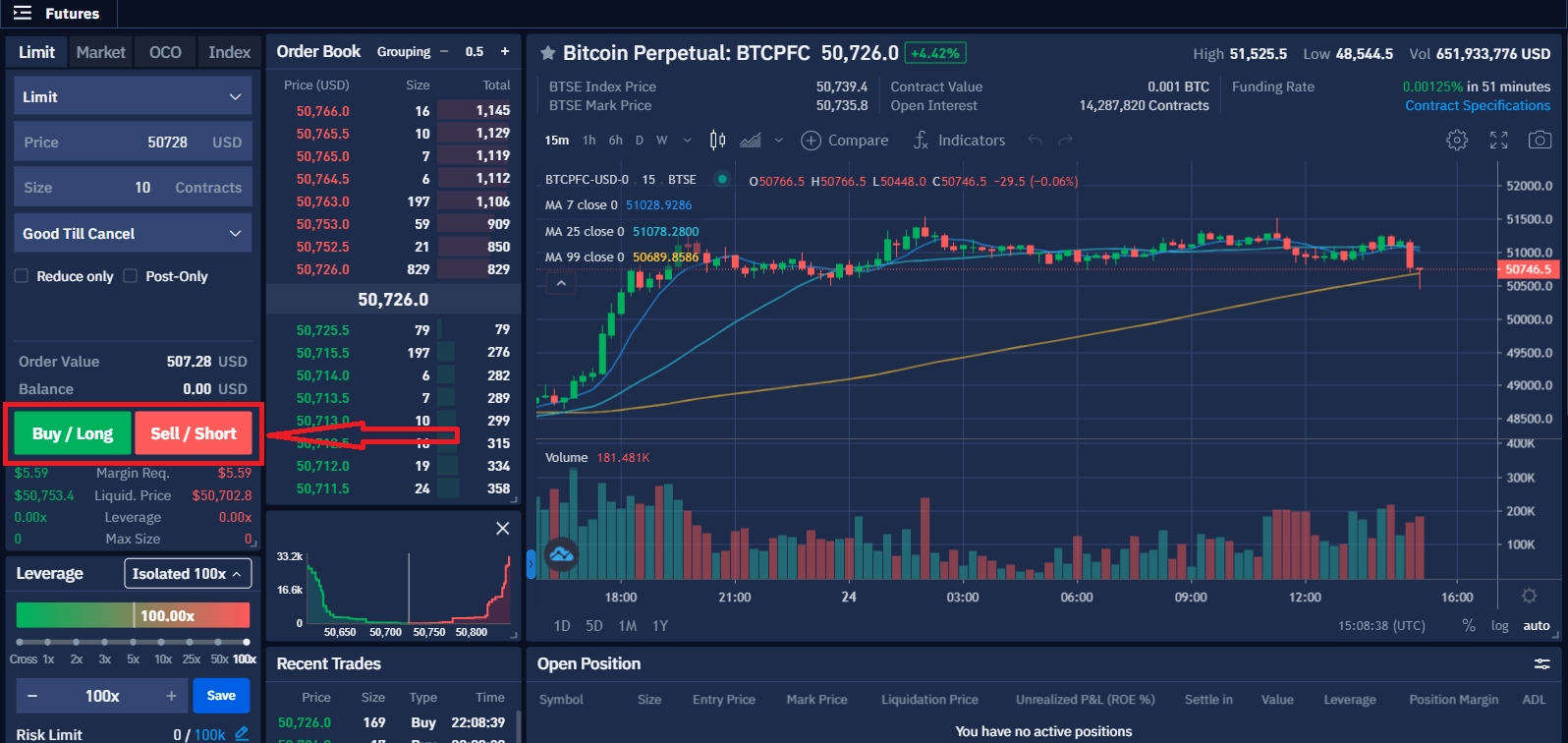

How to Trade Futures Contracts

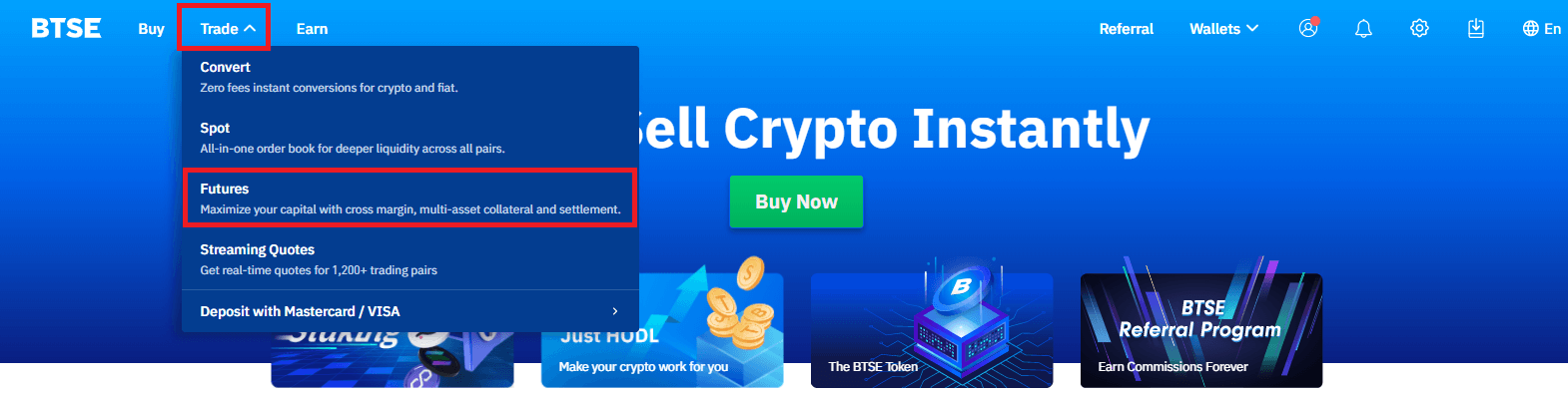

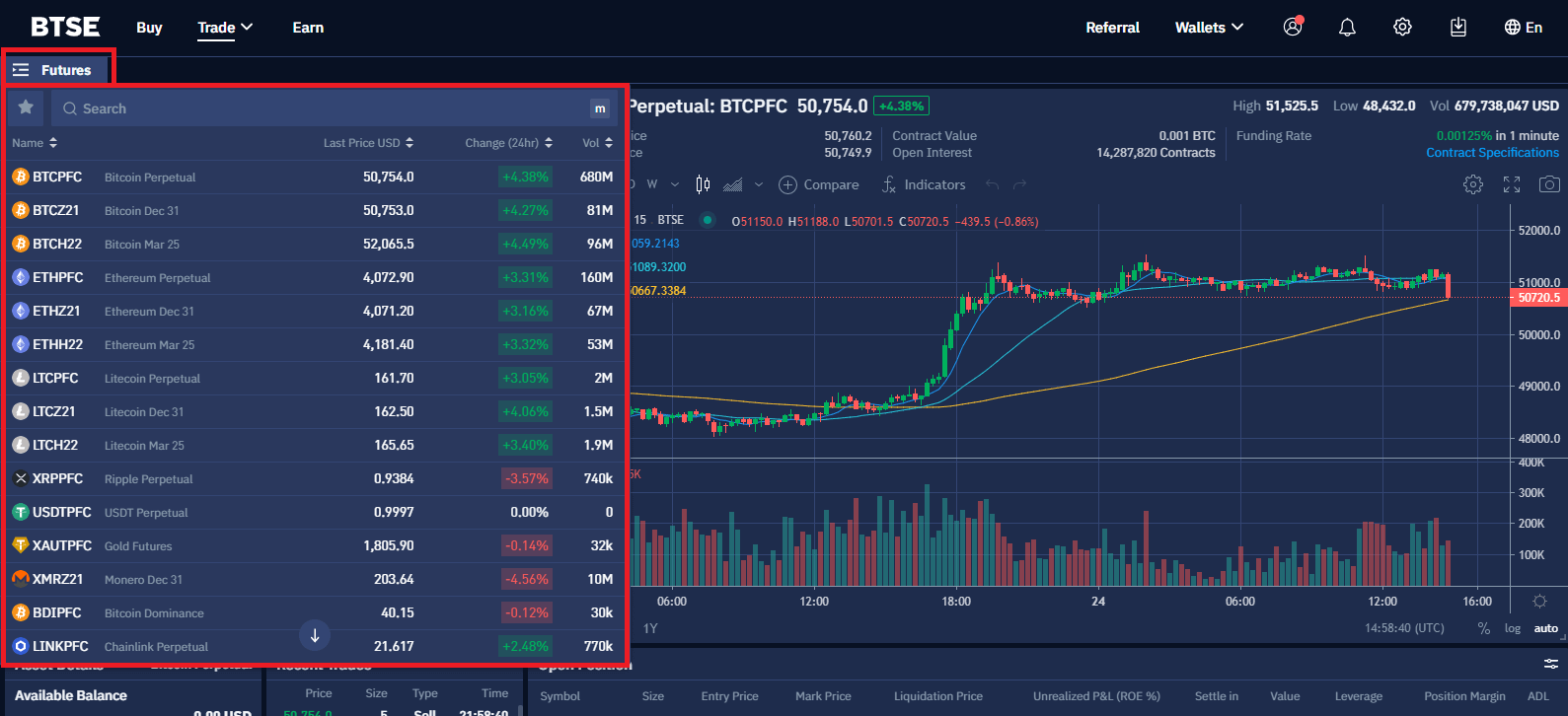

Step 1: Log in to your account. Click on "Futures" under "Trade" on the top navigation bar.

Step 2: Search and enter the pair you want to trade.

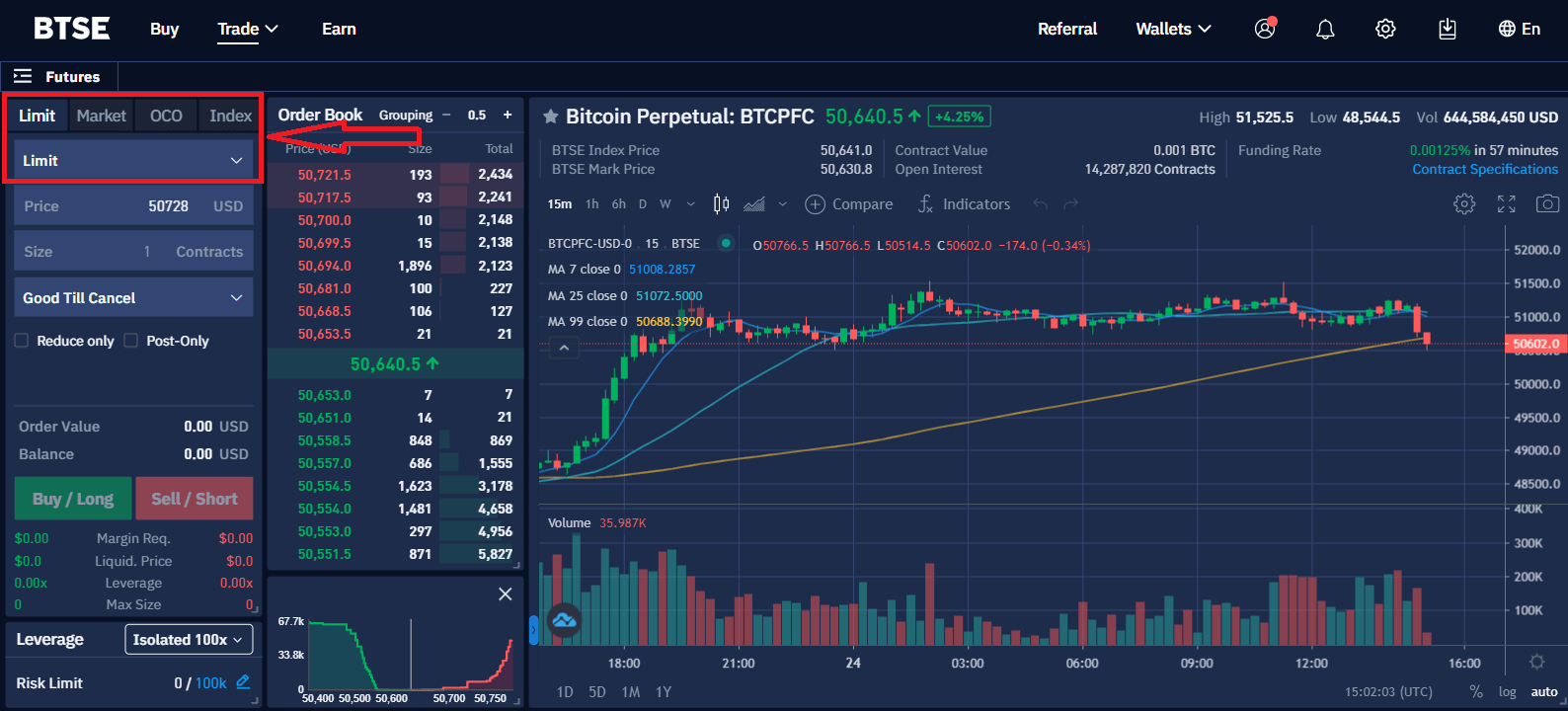

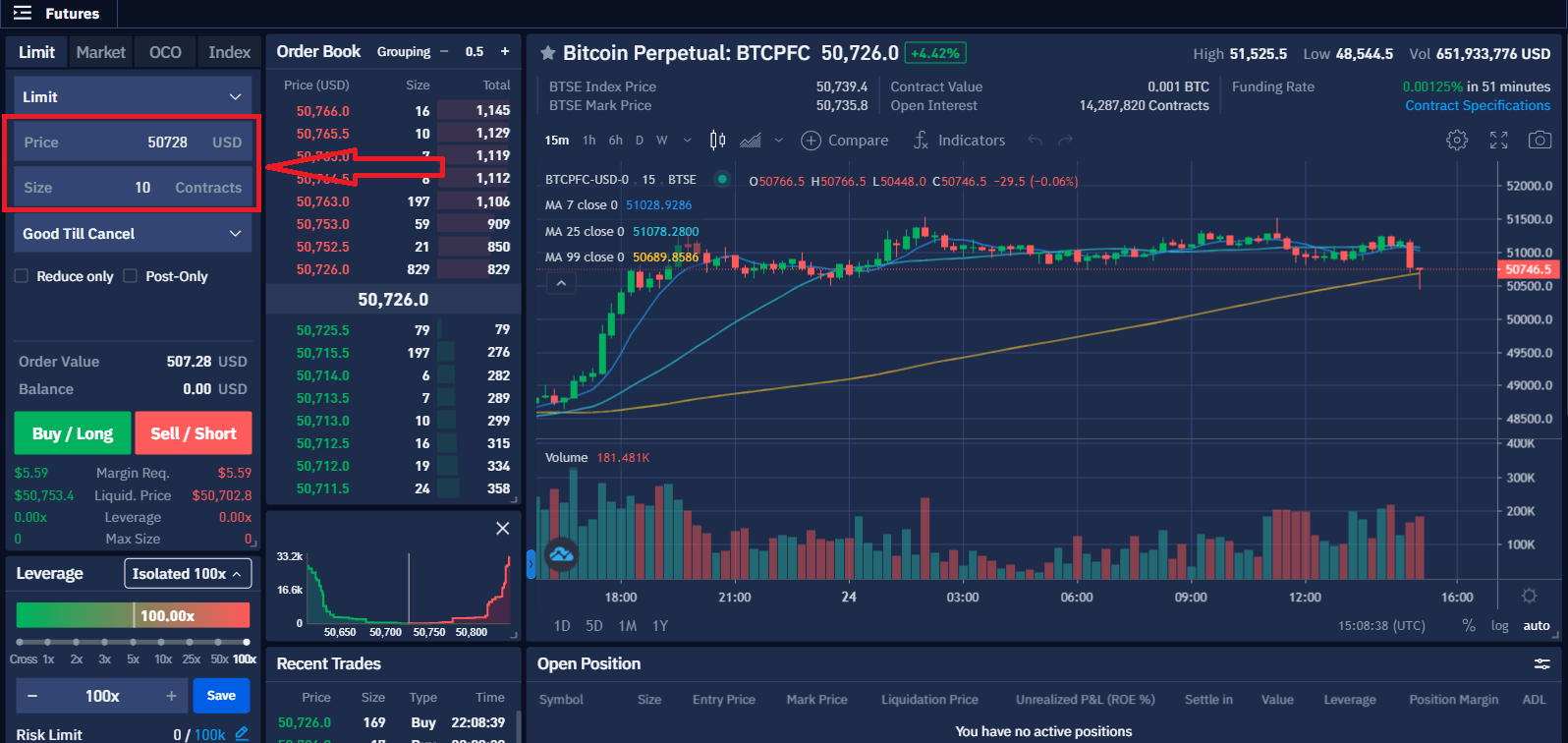

Step 3: Select an Order type.

Step 4: Enter the order price and size.

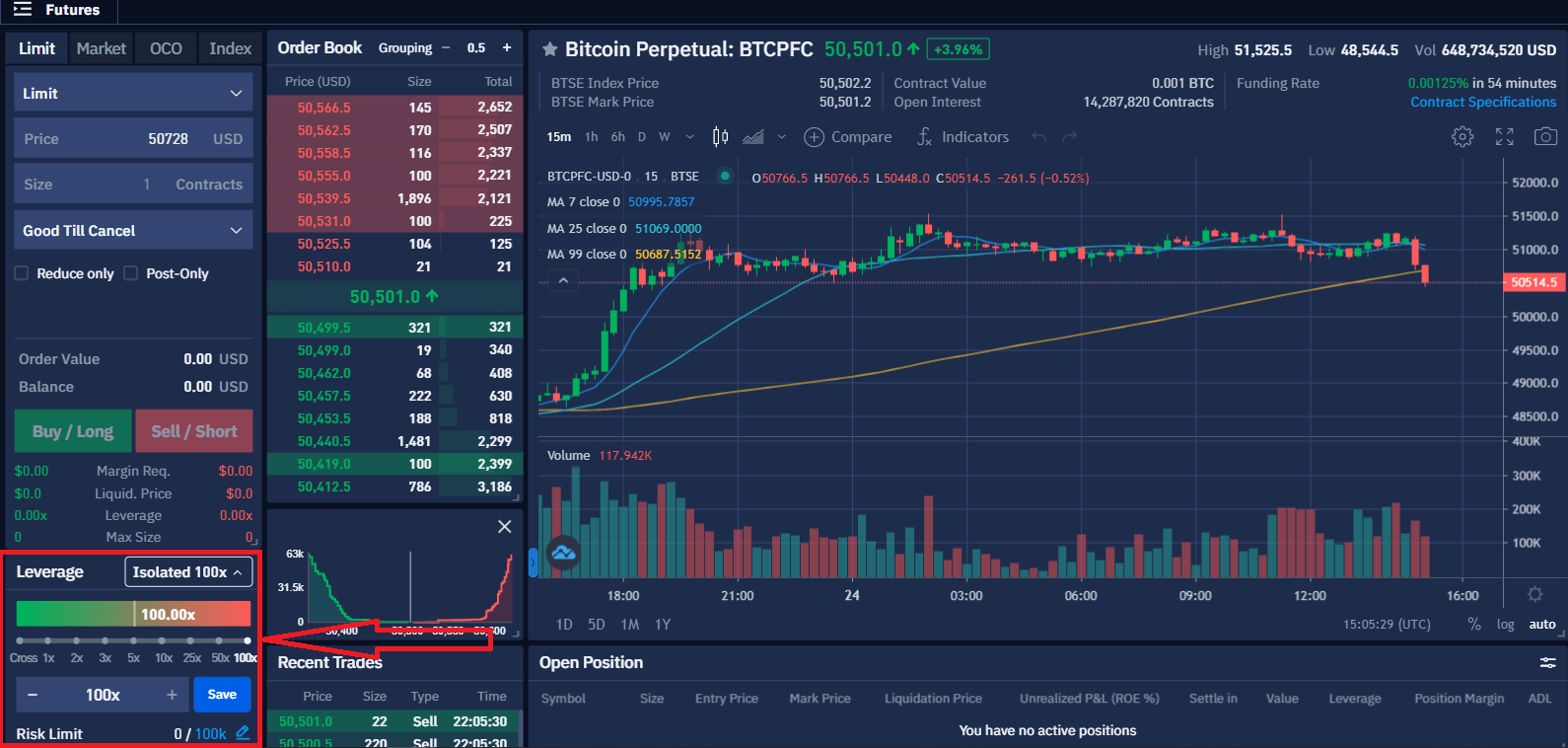

Step 5: Select a Leverage and Futures Wallet.

Step 6: Select "Buy / Sell" to submit your order.

Futures Trading Fees

Futures Trading Fees (Users)

- For futures trading, both the enter and settle positions will be charged trading fees. Trading fees will be deducted from your margin balance.

- Users who already joined the Market Maker Program, please refer to the next section: Futures Trading Fees (Market Maker).

- The account fee level is determined based on a 30-day rolling window of trading volume, and will be recalculated daily at 00:00 (UTC). You can see your current fee level on the Account Profile Page.

- Trading volume is calculated in BTC terms. Non-BTC trading volume is converted into the BTC equivalent volume at the spot exchange rate.

- Discounts are applied to taker fees only.

- The BTSE token discount cannot be stacked with the referee discount. If the conditions for both discounts are met, the higher discount rate will be applied.

- BTSE does not allow users to self-refer through multiple accounts.

| 30-Day Volume (USD) | BTSE Token Holdings | VIP Discount | Referee Discount (20%) | ||||

| Maker | Taker | Maker | Taker | ||||

| Or | 300 | - 0.0100% | 0.0500% | - 0.0100% | 0.0400% | ||

| ≥ 2500 K | And | ≥ 300 | - 0.0125% | 0.0500% | - 0.0125% | 0.0400% | |

| ≥ 5 M | And | ≥ 600 | - 0.0125% | 0.0480% | - 0.0125% | 0.0384% | |

| ≥ 25 M | And | ≥ 3 K | - 0.0150% | 0.0480% | - 0.0150% | 0.0384% | |

| ≥ 50 M | And | ≥ 6 K | - 0.0150% | 0.0460% | - 0.0150% | 0.0368% | |

| ≥ 250 M | And | ≥ 10 K | - 0.0150% | 0.0460% | - 0.0150% | 0.0368% | |

| ≥ 500 M | And | ≥ 20 K | - 0.0175% | 0.0420% | - 0.0175% | 0.0336% | |

| ≥ 2500 M | And | ≥ 30 K | - 0.0175% | 0.0420% | - 0.0175% | 0.0336% | |

| ≥ 5 B | And | ≥ 35 K | - 0.0200% | 0.0400% | - 0.0200% | 0.0320% | |

| ≥ 7.5 B | And | ≥ 40 K | - 0.0200% | 0.0380% | - 0.0200% | 0.0304% | |

| ≥ 12.5 B | And | ≥ 50 K | - 0.0200% | 0.0360% | - 0.0200% | 0.0288% | |

Futures Trading Fees (Market Makers)

- For futures trading, both the enter and settle positions will be charged trading fees.

- Market makers interested in joining BTSEs Market Maker Program, please contact [email protected].

| Maker | Taker | |

| MM 1 | -0.0125% | 0.0400% |

| MM 2 | -0.0150% | 0.0350% |

| MM 3 | -0.0175% | 0.0325% |

| MM 4 | -0.0200% | 0.0300% |

Perpetual Contracts

What is a Perpetual Contract?

The features of a perpetual contract are:

- Expiry Date: A perpetual contract does not have an expiry date

- Market Price: the last buy / sell price

- Underlying Asset of each contract is: 1/1000th of the corresponding digital currency

- PnL Base: All PnL can be settled in USD / BTC / USDT / TUSD / USDC

- Leverage: Allows you to enter a futures position that is worth much more than you are required to pay upfront. Leverage is the ratio of the initial margin to the order value of a contract

- Margin: Funds required in order to open and maintain a position. You can use both fiat and digital assets as your margin.

- The price of your digital asset margin is calculated based on an executable market price that is representative of your asset quality and market liquidity. This price may differ slightly from the prices you see on the spot market

- Liquidation: When the mark price reaches your liquidation price, the liquidation engine will take over your position

- Mark Price: Perpetual contracts use the mark price to determine your unrealized PnL and when to trigger the liquidation process

- Funding Fees: Periodic payments exchanged between the buyer and seller every 8 hours

What is Mark Price?

- To calculate the unrealized PnL

- To determine if liquidation occurs

- To avoid market manipulation and unnecessary liquidation

What are the differences between Market Price, Index Price and Mark Price?

- Market Price: The last price at which the asset was traded

- Index Price: The weighted average of the asset price based on Bitfinex/Bitstamp/Bittrex/Coinbase Pro/Krac

- Mark Price: Mark price: The price is used to calculate the unrealized PnL and the liquidation price of the perpetual contract

Leverage

Does BTSE offer leverage? How much leverage does BTSE offer?

What is Initial Margin?

- Initial Margin is the minimum amount of USD (or USD equivalent value) you must have in your margin wallets (Cross Wallet or Isolated Wallets) in order to open a position.

- For Perpetual Contracts, BTSE sets the Initial Margin requirement at 1% of the contract price (/Notional Value).

What is Maintenance Margin?

- Maintenance Margin is the minimum amount of USD (or USD Value) you must have in your margin wallets (Cross Wallet or Isolated Wallets) to keep a position open.

- For Perpetual Contracts, BTSE sets the Maintenance Margin requirement at 0.5% of the order price.

- When the Mark Price reaches the Liquidation Price, your margin will have fallen to the maintenance margin level, and your position will be liquidated.

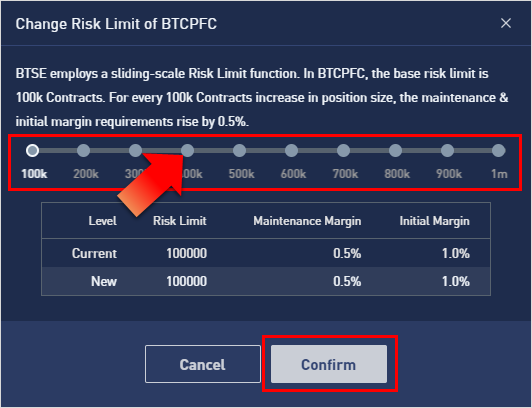

Risk Limits

When a large position gets liquidated, it may cause violent price fluctuations, and may also cause opposite side traders to be auto-deleveraged because the size of the liquidated position is larger than what the market liquidity can absorb.To reduce market impact and number of users being affected by liquidation events, BTSE has implemented the Risk Limits mechanism, which requires large positions to provide more initial margin and maintenance margin. By doing so, when a large position is liquidated, the probability of going into auto-deleveraging is reduced, and thus minimizing off market liquidations.

Important Reminder:

- You will need to manually increase your risk limit only when you desire to hold more than 100K contracts.

- Increasing the risk limit will also increase your initial and maintenance margin requirement. This moves your liquidation price closing to your entry price (which means it will increase the risk of getting liquidated)

Risk Limit Levels

There are 10 levels of risk limits. The larger the position, the higher the required maintenance margin and initial margin percentages.

In the BTC perpetual contract market, every 100k contracts you hold increases the threshold for maintenance and initial margin requirements by 0.5%.

(For risk limits in other markets, please refer to the risk limit panel description in the trading page)

| Position Size + Order Size | Maintenance Margin | Initial Margin |

| ≤ 100K | 0.5% | 1.0% |

| ≤ 200K | 1.0% | 1.5% |

| ≤ 300K | 1.5% | 2.0% |

| ≤ 400K | 2.0% | 2.5% |

| ≤ 500K | 2.5% | 3.0% |

| ≤ 600K | 3.0% | 3.5% |

| ≤ 700K | 3.5% | 4.0% |

| ≤ 800K | 4.0% | 4.5% |

| ≤ 900K | 4.5% | 5.0% |

| ≤ 1M | 5.0% | 5.5% |

In the contrary, if you have closed the large position and would like to return to the normal maintenance margin and initial margin level, you have to manually adjust the risk limit level.

For example:

You have 90K BTC perpetual contracts, and would like to add another 20K contracts.

Since 90K + 20K = 110K, you already exceeded the 100K risk limit level. So when you place the 20K contract order, the system will prompt you to increase the risk limit level to 200K level before you can place the new order.

After you close the 110K position, you have to manually adjust the risk limit back to 100K level, then the thresholds for the maintenance margin and the initial margin will return to the corresponding percentage.

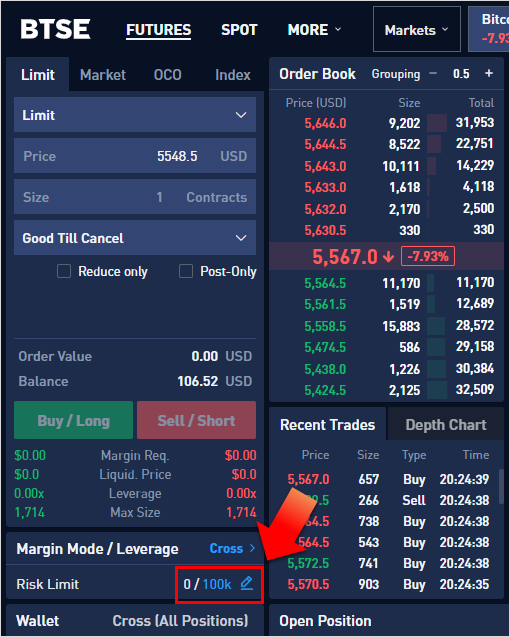

How to Adjusting Your Risk Limit

1. Click the Edit Button on the risk limit tab

2. Click the Level you would like to use, and then click Confirm to complete the setting